Crystal Swan Group

Clarity - Capital - Communication

About

Crystal Swan Group is a passionate community dedicated to elevating your standard of living through financial literacy and collaboration. We believe financial knowledge is the cornerstone of a fulfilling life, and we bridge the gap between knowledge and action.We understand that finance is a complex landscape, intertwined with history, economics, psychology, and more. Our mission is to empower you to navigate this complexity with confidence. Regardless of your current financial literacy, we offer valuable resources to expand your financial IQ and unlock your full potential.At Crystal Swan Group, you'll find:Comprehensive Education: Gain a deep understanding of financial concepts to make informed decisions for your future.Collaborative Community: Connect with like-minded individuals, share experiences, and build a support system for your financial success.Actionable Insights: Put your knowledge into practice with our practical tools and valuable resources.Whether your goal is personal financial wellness or sharing your knowledge to improve the lives of others, the Crystal Swan Group welcomes you. Together, we can build a brighter financial future for ourselves and future generations.Get in touch!

Contact

Please direct inquiries to:

Store

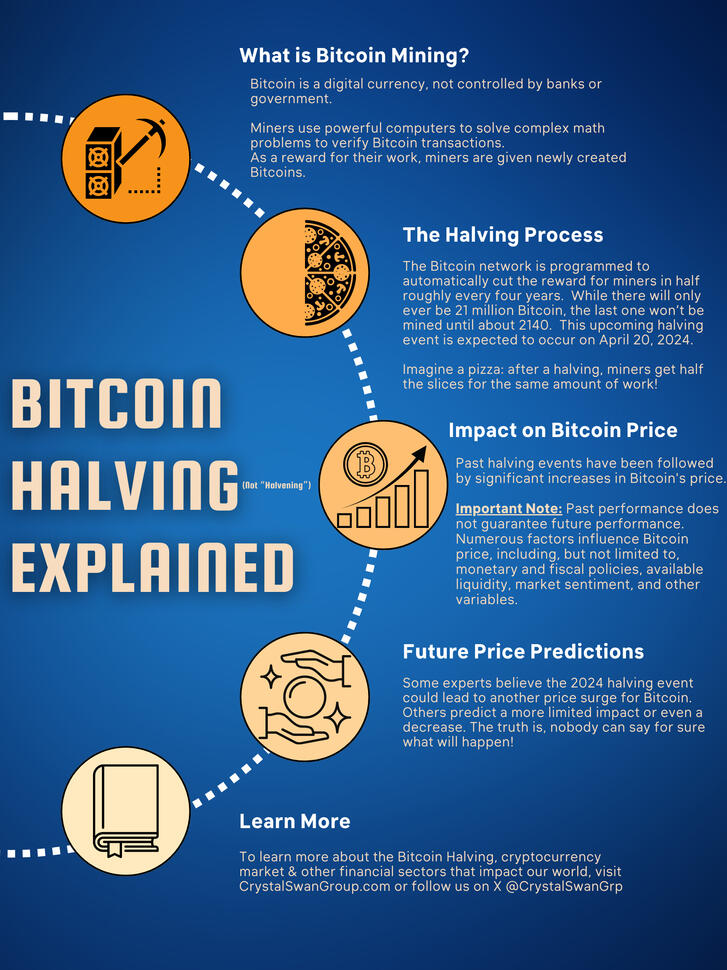

Trading For BeginnersLearn to trade stocks, forex, crypto, and more with confidence. Master the fundamentals of technical analysis (TA) like candlestick patterns, charts, support and resistance, and essential technical indicators. Discover how to trade with a winning mindset, incorporating crucial trading psychology and risk management techniques to help you avoid common pitfalls like bull and bear traps.Whether you're a complete novice or looking to solidify your trading foundation, this guide is your first step to making money and achieving profitable trades. Unlock the secrets of the market and start your journey to financial freedom today!

The first volume in a series

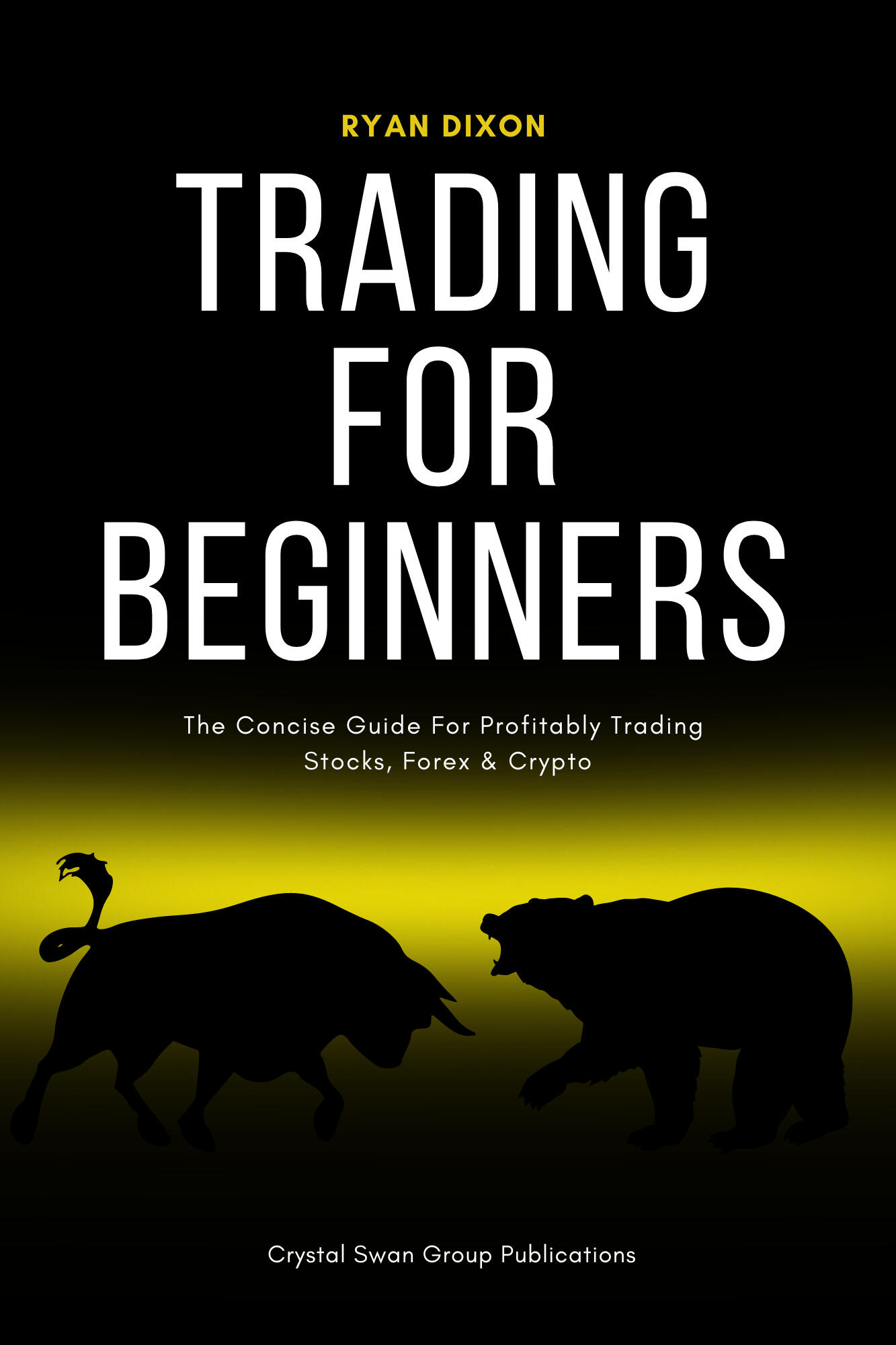

Trading For Beginners II

Master Technical Analysis: Profit from Market PatternsDecode the language of the markets with technical analysis! Learn candlestick patterns, chart reading, support/resistance, and key indicators. Craft personalized trading plans, interpret news events, and manage risk effectively.In Volume II, Master:Market Insights: Decipher chart patterns, news, and Fibonacci for accurate predictions.

Winning Strategies: Build personalized trading plans that match your style and risk tolerance.

Risk Mitigation: Use stop-loss and take-profit orders for confident trade execution.

Spot Reversals: Identify trend shifts early with divergence analysis.

Fibonacci Precision: Pinpoint crucial support/resistance levels for smarter entries and exits.

TradingView Alerts: Automate your watchlist for timely, informed decisions.

Transform your trading potential into consistent profits! Whether you're a day trader, swing trader, or long-term investor, this guide empowers you to analyze, decide, and execute winning trades.Unlock the secrets of technical analysis and accelerate your path to financial freedom. Get "Trading for Beginners: Volume II" today!

The second volume in a series

Blog

Crack-Up Boom: Is Our Economic Boom About to Bust?

Gold on the Rise:

Why You Should Consider Adding Gold to Your Portfolio

Inflation:

The Silent Thief Stealing Your Wealth –

How to Understand, Fight Back, & Win

Inflation might sound like a bland economic term, but it has real-world consequences for your wallet. Think of it like a hidden tax on the things you buy every day. A few dollars here and there might not seem like much, but over time inflation adds up, eroding your hard-earned savings and making it harder to afford the life you want. But knowledge is power! In this guide, we'll break down:What inflation is and why it's happening nowHow inflation directly impacts your financesSmart strategies to shield your wealth and even thrive amidst rising costsWhere to find trustworthy resources to boost your financial literacyInflation 101: The Basics You Need to KnowIn simple terms, inflation is the gradual increase in the prices of goods and services over time. Picture it like this: that $10 bill that bought you a delicious pizza today might only get you a few slices in a year if inflation is high. This decrease in what your money can buy is called a loss of purchasing power.Why Inflation Is Spiking Right Now

It's not just your imagination – prices really are going up! Several factors contribute to the current inflationary environment:Supply Chain Chaos: The COVID-19 pandemic caused significant disruptions in how goods are produced and transported worldwide, making things scarcer and more expensive.The Ukraine War: has driven up energy and food prices globally.Government Spending: Large-scale government stimulus programs to ease pandemic hardships may have inadvertently fueled inflation.Inflation's Bite: How It Hurts Your Financial Well-Being

Inflation can hit your finances in several ways:Paycheck Power Drain: If wages don't keep pace with inflation, your paycheck's buying power shrinks, meaning you get less for the same work.Savings Erosion: If your savings interest rate is lower than inflation, you're actually LOSING money over time.Budget Buster: Unpredictable price increases make it harder to stick to a budget and plan for the future.Dream Delayer: Rising costs can force you to postpone big purchases or life goals like buying a home or retiring early.The Federal Reserve Connection: Understanding Their RoleThe Federal Reserve (the Fed) is the central bank of the United States and plays a significant role in managing inflation. One of their tools is controlling the money supply. When the Fed pumps more money into the economy, it can devalue existing dollars. Think of collectibles: a rare item is valuable, but flood the market with copies, and its value plummets. The same dynamic can happen with currency.Outsmarting Inflation: Strategies for Protecting and Growing Your WealthThe Budgeting Masterclass: Creating a detailed budget is your first line of defense. Track your income and expenses to spot areas where you can cut back and redirect money toward battling rising costs.Savvy Shopper Tactics: Become a comparison-shopping ninja! Use coupons, seek out sales, explore store loyalty programs, and consider generic brands when they make sense.Inflation-Proof Your Investments: While seeking professional financial advice is always wise, certain investments can outpace inflation. These might include gold, bitcoin, stocks, or real estate depending on market conditions. Remember, diversification is crucial to managing risk.Negotiate Your Worth: If inflation persists, don't be afraid to talk to your employer about a cost-of-living salary adjustment.Debt Demolition: High-interest debt is a significant drag on cash flow during inflationary times. Focus on aggressively paying down credit cards and other high-interest loans.Inflation can feel overwhelming, but you don't have to navigate it alone. For ongoing tips, strategies, and a supportive network dedicated to financial empowerment, follow us on X @CrystalSwanGroup. Together, we can beat inflation and secure a brighter financial future!

This article provides a foundation for understanding inflation. If you'd like to delve deeper, here are some helpful resources:The Bureau of Labor Statistics Consumer Price Index

(This website tracks inflation data and provides valuable insights)The Federal Reserve

(The central bank offers educational resources on inflation and the economy)The National Endowment for Financial Education

(This non-profit provides a wealth of resources for improving your financial literacy)By taking advantage of these resources and implementing some of the strategies outlined above, you can face inflation with confidence and take control of your financial future.

Gold on the Rise: Why You Should Consider Adding Gold to Your Portfolio

Gold has been a valuable commodity for centuries, used as currency, jewelry, and a store of value. In recent months, the gold market has seen a surge in activity, with prices reaching record highs. This article will explore the recent developments in the gold market, what drives the price increase, and why gold might be a good investment for your portfolio.Recent Developments in the Gold Market

Several factors are contributing to the recent rise in gold prices. Here's a closer look at some of the key drivers:Geopolitical Tensions: The ongoing conflict between Iran and Israel has caused investors to seek safe-haven assets like gold. When the global economy is uncertain or political instability occurs, investors tend to flock to gold, which is seen as a safe and reliable investment.Potential for Further Inflation: The global economy remains under pressure from various factors, and some investors fear inflation may continue to rise or return. Gold is seen as a hedge against even higher inflation.Weakening US Dollar: A weakening US dollar can also lead to a rise in gold prices. This is because gold is often priced in US dollars, so when the dollar weakens, gold becomes more affordable for investors holding other currencies.Increased Demand from China: China is the world's largest consumer of gold, and its demand for the metal has increased in recent years. This is due to several factors, including China's growing middle class, its increasing investment in gold as a hedge against inflation, and its government's efforts to diversify its foreign reserves.Market Uncertainty: The stock market has been volatile, leading some investors to seek assets perceived as safer and less prone to sudden price drops.Why Invest in Gold

There are several reasons why gold can be a valuable addition to your investment portfolio:

Safe Haven Asset: As mentioned earlier, gold is a safe-haven asset, meaning it tends to hold its value or even increase in value during economic or political uncertainty. This is because investors see gold as a reliable store of value that is not subject to the same risks as stocks or bonds.Hedge Against Inflation: Gold can also act as a hedge against inflation. Over time, inflation erodes the purchasing power of fiat currencies like the US dollar. Gold, on the other hand, has a long history of maintaining its value.Diversification: Including gold in your portfolio can help you diversify your holdings and reduce overall risk. Gold tends to have a negative correlation with stocks and bonds, meaning that when stocks and bonds go down, gold prices often go up.How to Invest in Gold

There are several ways to invest in gold. Here are a few of the most common options:

Physical Gold: You can buy physical gold coins or bars. This is a good option for investors who want to own gold directly, provided they have suitable storage solutions.Gold ETFs: Gold ETFs (exchange-traded funds) are a popular way to invest in gold without having to own the metal physically. They track the price of gold, so their value goes up and down along with it.Gold Mining Stocks: You can also invest in gold by buying gold mining company stocks. This can be a more volatile way to invest in gold, but it also has the potential for higher returns.Is Gold a Good Investment for You?

The decision of whether or not to invest in gold is a personal one. There are many factors to consider, such as your investment goals, risk tolerance, and investment time horizon. However, given the recent rise in gold prices and the factors driving that increase, gold may be a good investment to consider adding to your portfolio.

Here are some additional things to keep in mind before investing in gold:Not all gold is created equal: Different classes of metals (bullion vs investment grade coins) have different advantages and disadvantages. It’s crucial to consider your unique investor profile to determine which categories (if any) complement your personal goals best.

Gold does not pay dividends or interest: You will not earn any income from your gold investment.

The price of gold can be volatile: The price of gold bullion can fluctuate significantly in the short term.Conclusion

Gold has been a valuable asset for centuries and is a relevant investment option today. The recent rise in gold prices is being driven by several factors, including geopolitical tensions, a weakening US dollar, and increased demand from China. With economic and market uncertainties lingering, gold's role as a safe haven, a hedge against inflation, and a portfolio diversifier is more vital than ever.

If you're considering adding gold to your portfolio, owning physical gold coins or bars provides a sense of direct ownership and control. It's a tangible asset with a long history of preserving wealth.

Before making any significant investment decisions, it's essential to consult with a registered financial advisor. They can assess your individual circumstances, risk tolerance, and financial goals to help you determine if and how gold might fit into your investment strategy.

This article provides a foundation for understanding the current gold market. If you'd like to delve deeper, here are some helpful resources:World Gold Council: Explore comprehensive gold market data, analysis, and insights.US Gold Bureau: Explore the differences between investment grade and bullion gold.Goldhub: Get the latest gold prices, charts, and industry news.Kitco News: Access up-to-date precious metals market news and commentaries.U.S. Mint: Find information on buying gold coins and bullion directly from the U.S. Mint.

Crack-Up Boom: Is Our Economic Boom About to Bust?

The concept of the "Crack-Up Boom," theorized by renowned Austrian economist Ludwig von Mises, describes a deceptive but ultimately unsustainable economic surge. Fueled by reckless credit expansion and artificial monetary manipulation, this boom creates an illusion of wealth and opportunity, culminating in a potentially devastating financial collapse.In this article, we delve deeper into the dynamics of the Crack-Up Boom, examine telltale signs within the current economic landscape, and explore strategies to safeguard your financial well-being and potentially profit amidst the turmoil.The Mechanics of a Crack-Up BoomTo understand the Crack-Up Boom, let's consider the following scenario:The Fuel: Easy Credit and Monetary Expansion

Central banks like the Federal Reserve slash interest rates to stimulate economic activity. This makes borrowing extremely cheap, encouraging individuals and businesses to take on more debt. Alongside this, central banks may pump money into the economy by buying bonds. This artificial boost in available money creates a sense of temporary liquidity.The Boom: Misguided Investments and Asset Bubbles

Flooded with cheap credit, businesses embark on ventures that may seem profitable only due to artificially low-interest rates. These investments are often misdirected into speculative endeavors or assets with little intrinsic value. As a result, asset prices, such as stocks and real estate, become inflated, forming economic bubbles.The Illusion: Inflation and the Distortion of Value

The excessive expansion of the money supply inevitably leads to inflation. As more dollars chase fewer goods and services, prices rise across the board. This gradual erosion of purchasing power becomes a silent thief, shrinking the value of your savings, wages, and investments.The Tipping Point: Rising Panic and Loss of Trust

At some point, the weight of debt, inflation, and economic distortion triggers a shift in market sentiment. Investors sense that the boom is built on shaky foundations, causing them to seek a safe haven for their wealth desperately. As trust in the currency collapses, people start fleeing into tangible assets with intrinsic value to preserve their purchasing power.The Crack-Up: Hyperinflation and Economic Chaos

If central banks, desperate to keep the party going, continue their excessive monetary expansion, inflation can spiral into hyperinflation. Prices rise at an alarming rate, causing a complete breakdown of the monetary system. The currency becomes virtually worthless, plunging the economy into deep recession or even depression.Historical Case Studies of the Crack-Up BoomLet's examine how nations fell prey to the Crack-Up Boom and the hardships their citizens endured:

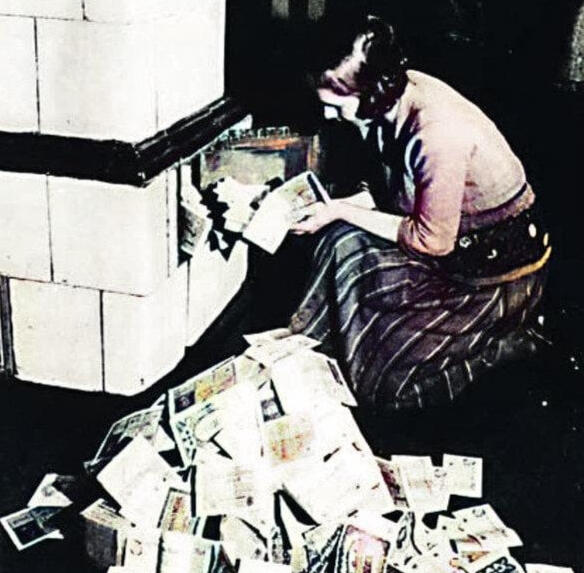

Weimar Germany (1920s): Following World War I, Germany faced crippling reparations payments. The German government resorted to printing vast amounts of money to alleviate debt burdens. This triggered hyperinflation – bread that cost a few marks in 1922 could cost billions by 1923. Ordinary Germans saw their life savings evaporate overnight. Economic chaos paved the way for political extremism and ultimately contributed to the rise of the Nazi regime.

Zimbabwe (2000s): Under Robert Mugabe's rule, Zimbabwe's government embarked on reckless money-printing and destructive economic policies. Hyperinflation reached astronomical levels, with estimates suggesting a mind-boggling 80 billion percent inflation rate by 2008. Zimbabweans witnessed their currency's value vanish within hours, leading to extreme poverty, food scarcity, and social unrest.

Venezuela (Present): Years of economic mismanagement and socialist policies in Venezuela have culminated in one of the worst financial collapses in modern history. The country is mired in hyperinflation, with citizens struggling to afford basic necessities. Living standards have plummeted, prompting a humanitarian crisis and a mass exodus of desperate Venezuelans.Signs of a Crack-Up Boom in Today's EconomyLet's dissect a few warning signs suggestive of a potential Crack-Up Boom brewing in the present economic climate:Unprecedented Debt Levels: In many developed economies, Household, corporate, and government debt have reached record highs. This over-leveraged environment could become a significant vulnerability if interest rates rise or economic conditions worsen.Continued Monetary Easing: Central banks have engaged in massive monetary interventions for over a decade. The prolonged influx of cheap money and historically low interest rates could inflate asset bubbles and distort market signals.Inflationary Pressures: Despite initial claims of inflation being "transitory," rising economic prices are becoming harder to ignore. If inflationary pressures get out of hand, it poses a severe threat to the stability of the monetary system.Social and Political Tensions: The widening gap between those who benefit from asset bubbles and those struggling with inflation could breed anger and resentment, fueling social unrest and political instability.How to Safeguard and Thrive During a Crack-Up BoomWhile a Crack-Up Boom presents a significant challenge, it can also create opportunities to protect and even grow your wealth. Consider the following strategies:Debt Elimination and Financial Prudence: Prioritize paying off high-interest debt as quickly as possible. Focus on building an emergency fund to weather unexpected economic storms. Adopt a frugal mindset and save as much as you can.Strategic Asset Allocation: Diversify your portfolio across asset classes that traditionally hedge against inflation. This includes:

Precious Metals: Gold and silver have historically held their value during periods of economic turmoil.Real Estate: Tangible property can provide income and potential appreciation, serving as an inflation hedge.Commodities: Essential commodities like oil and agricultural products tend to rise in price during inflationary periods.Alternative Investments: Consider venturing into cryptocurrency and other decentralized financial instruments (consult with an expert, as these are high-risk, high-reward sectors).Shorting Overvalued Assets: For advanced investors, shorting inflated stocks or housing markets that are likely to experience a steep decline can be a highly lucrative (yet very risky) strategy.Upskilling and Adaptability: Invest in your education and skills to remain an in-demand asset in the changing job market. Be ready to adapt to new economic realities.Key Takeaways

The Crack-Up Boom is a reminder that economic growth built on artificial foundations is inherently unsustainable. While its timing and severity are unpredictable, understanding its mechanics puts you in a position of power. By maintaining a level head, prioritizing debt reduction, investing strategically, and remaining adaptable, you can weather the storm and potentially emerge in an even stronger financial position.

This article provides a foundation for understanding the consequences of misguided fiscal and monetary policy. To learn more about the crack up boom cycle, Ludwig Von Mises and other related useful information, please consider exploring the following:Mises Institute: Explore Austrian Economics, Ludwig Von Mises, The Crack Up Boom Theory and more.Foundation For Economic Education: Explore news, videos, books and more on a variety of subject matter including Austrian Economics.European Center For Austrian Economics Foundation - ECAEF: Explore more about the crack up boom cycle in this ECAEF article.

Waitlist

We're building a vibrant network where financial knowledge thrives. Whether you're a beginner, a seasoned investor, or an expert in a particular area of finance wanting to share your knowledge, you're invited to join our waitlist and secure a limited spot in our community. Get first access to our curated content, expert insights, and the support you need to reach your financial goals.